By Ms. Thathsarani Siriwardana

As we have reached Menstrual Hygiene Day 2023, it is imperative to encourage people to normalise menstruation worldwide. But as citizens of Sri Lanka, we still have to fight to get rid of the onerous para tariffs imposed on feminine hygiene items. It is depressing that women are being taxed for a normal biological procedure, and they shouldn't have to battle this fundamental right. Unfortunately, there is still a need to spread awareness and fight to have these para tariffs removed.

In 2023, the government issued a lengthy gazette comprising 261 pages, outlining various items exempted from paying para tariffs (PAL). This extensive list includes firearms, aircraft, clothing, and more. Unfortunately, sanitary napkins were not included among the exempted items in this gazette.

Current context

Despite the announcement made by the President's Media Division over nine months ago regarding the removal of tariffs on menstrual products and their associated raw materials imported into the country, no official gazette has been issued to date regarding the implementation of this proposal.

The removal of para tariffs will help to reduce the prices of domestically-produced sanitary napkins considerably. Nevertheless, the tariff cuts on sanitary napkins should be a part of a broader overall reform of the tariff structure rather than an ad hoc adjustment.

The current total tariff on sanitary napkins is 46.9 per cent. Although the current tariffs are much lower than they were historically, they are still quite high, so access to affordable and safe menstrual products remains a luxury for some women.

Sanitary napkins are vital for girls and women. High protective tariffs imposed on these products benefit producers, but this is at the expense of consumers. The inability to afford sanitary napkins in Sri Lanka is pervasive, especially among the low-income segment of society.

How higher tariffs hinder women’s choice

It is evident that the imposition of tariffs on menstrual hygiene products primarily benefits producers, as it shields them from competition. The existing cumulative tariff rate of 46.9 per cent, comprising 15 per cent Value-Added Tax (VAT), 10 per cent Port and Airport Levy (PAL), and 15 per cent CESS, is a significant improvement compared to the previous tariff structure. Nevertheless the current structure still results in higher prices.

When protective tariffs are applied to a particular item, they serve two primary purposes. Firstly, they act as a barrier to prevent new products from entering the domestic market. This restriction reduces competition and limits the options available to women when purchasing sanitary napkins. Secondly, high tariffs ultimately lead to elevated prices for both domestically-produced and imported goods.

Sri Lankan women and girls encounter difficulties in selecting menstrual hygiene products that suit their needs. The ability to choose is dependent on the affordability and accessibility of the products. The current high tariff rates impede the freedom of choice for women and girls.

By reducing tariffs, the cost of importing products will decline, fostering competition and subsequently driving down prices. This approach will incentivise local producers to innovate and develop higher-quality products while ensuring that their prices remain competitive and affordable in the market.

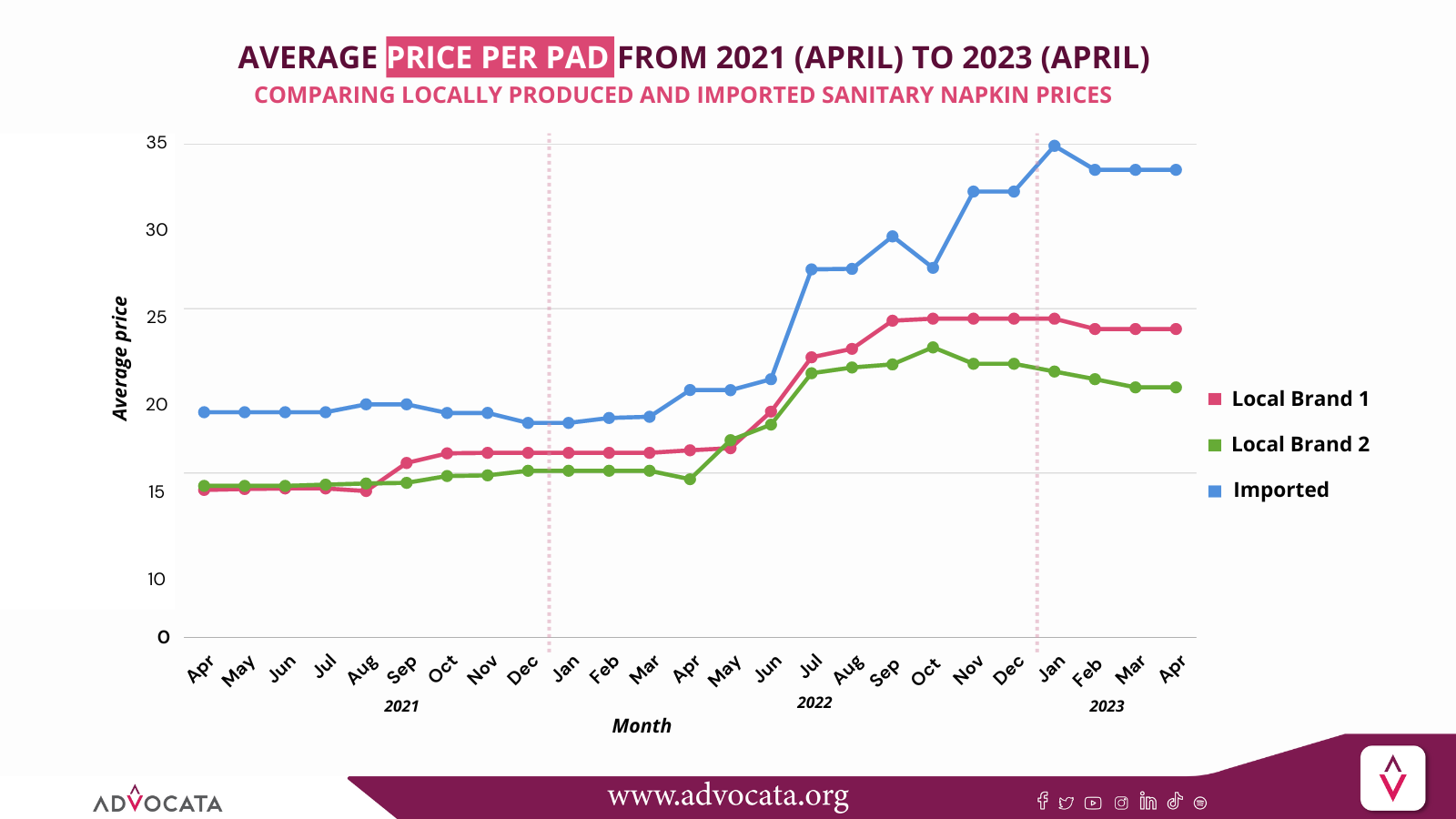

A market price analysis of sanitary napkins done by Advocata Institute found that by April (2023) the average price per pad for imported products remained higher than the costliest locally-produced alternative. The cheapest available price per pad currently stands at Rs. 30. Within a year, both local and imported brands witnessed a significant price increase of over 70 per cent.

The substantial price hikes can be attributed to various economic factors, including the depreciating exchange rate and high inflation rates. Additionally, the presence of high para-tariffs contributes to the rising prices. Eliminating the protectionist tariffs imposed on sanitary napkins and menstrual hygiene products would bring some relief to low-income women.

According to the Advocata Institute, in 2016, approximately 50 per cent of Sri Lankan households with menstruating women experienced absolute household period poverty, indicating that they did not include sanitary napkins in their household expenses. In 2019, this figure improved to around 40 per cent. However, the ongoing economic crisis is expected to exacerbate the situation.

To alleviate this issue, the government should prioritize the removal of the 10 per cent Port and Airport Levy (PAL) and the 15 per cent CESS imposed on imported sanitary napkins. This step would foster competition in the domestic market and offer more affordable and healthier choices for women.

Tariff structure reforms

The tariff structure in Sri Lanka is characterised by complexity, lack of organisation, and the inclusion of multiple para-tariffs and duties. This current protectionist import tax system has substantial adverse effects on both exports and the domestic economy.

To initiate these reforms, it is essential to consolidate the existing Customs duty and para-tariffs such as PAL, VAT, CESS, surcharge, among others, into a single Customs duty. Simplifying the tariff system calls for the application of a single rate wherever possible within each Harmonized System (HS) code. Furthermore, a uniform tariff rate should be implemented for raw materials and components used in various industries.

For over three years, our advocacy has focused on the elimination of para-tariffs on menstrual products. While some progress has been made during this time, there is still much work to be done. Taxing menstrual products is inherently discriminatory and should be completely abolished. If the government has the ability to exempt certain items from the Port and Airport Levy (PAL), it demonstrates that they have the capacity to eliminate para-tariffs altogether. It is ultimately a matter of political will and prioritisation.

(The writer is a Research Assistant at the Advocata Institute and can be contacted at thathsarani@advocata.org).

Leave Comments