- Last Update 2025-08-27 12:14:00

IRD tightens grip on Liquor License holders

Liquor license holders must clear all pending taxes to renew their licenses for next year and the Tax Clearance Certificate will be sent directly to the Excise Department unlike in the past when license holders submitted it by themselves, a senior official of the Inland Revenue Department said.

Accordingly, license holders are required to pay Income Tax, Value Added Tax (VAT), and Social Security Contribution Levy based on the returns they made and if they have registered for any other taxes, those payments also should be cleared to secure the certificate.

“The Excise Department introduced a new system this time where the Inland Revenue Department will send the Tax Clearance Certificates directly to the department after license holders cleared their pending tax payments and cleared from compliance of relevant tax payments,” Commissioner General (Acting) D.U.A. Jayawardhana said.

To do this, the Acting Commissioner General stressed that the department requires consent from the license holders to send their tax clearance certificate to the Excise Department directly.

You can share this post!

-

Still No Comments Posted.

Name

Content

- August 22, 2025 - 239 - 0

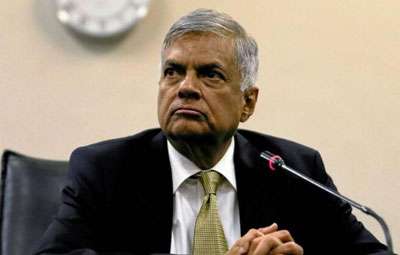

Ranil W. remanded till August 26

Former President Ranil Wickremesighe was remanded till August 26 by Fort Magistrate Nilupuli Lankapura a short while ago.

- August 22, 2025 - 206 - 0

Ranil Wickremesinghe arrested

Former President Ranil Wickremesinghe was arrested by the CID this afternoon in connection with the misuse of public funds.

Related Articles

Top stories for today

- 26/08/2025 - 88 - 0

Ranil Wickremesinghe granted bail

- 26/08/2025 - 133 - 0

Court hearing of Ranil Wickremesinghe’s case opens

- 26/08/2025 - 76 - 0

Former President unable to attend court proceedings today: Dr Bellana

- 26/08/2025 - 66 - 0

Leave Comments