The famous author Stephen Phinker, a finalist in the Pulitzer price, in his book “Blank Slate” argued that what we perceive as real is sometimes distorted by our own expectations. This is the basis of optical illusion. A good example: recently the opposition members, like many of us (an opposition member of Parliament was quoted as saying) thought that the GDP growth of 8.3% for the year 2011 reported by the Central Bank is achieved through high government spending, and with little private sector investment is due to the lack of confidence in the economic policies of this regime.

|

| View from Water’s Edge jogging track |

This was confirmed by some others who visited and travelled in and around the country and witnessed ongoing large scale construction projects such as highways, ports and airports, water supply projects, UDA development works, etc undertaken by the Government. To be honest, the writer was also of the view that most of the investments are coming from the General Treasury where almost all infrastructure development projects are being carried out by the public sector institutions funded by Chinese and other foreign lending organisations.

However by perusing the Central Bank report just released for 2011, it was evident that the private sector investments are also on the rise and in fact, it was 23.7% of the GDP in 2011 whereas, in 2002 the private sector investment ratio as a % of GDP was only 16.6% and, the total investment ratio was only 21.1% as against 29.9% in the year 2011.

It is relevant to mention here that the annual investment ratio as a % of GDP was always less that 29.9% for the last 50 years, except in 1980 and 1982 where the ratio was above 30%.

We could most likely attain a sustainable economic growth of over 8% for the next couple of years as well, if we are able to achieve a total investment of 35% of the GDP with a breakdown of 5% from the government and the balance 30% from the private (the probable private sector investment ratio would ideally be six times more than the investment figure of the government).

The Asian Development Bank in its regional report released just after the New Year holidays has commended the economic achievements of the country. However they have said that building investor confidence is important and this requires a predictable policy environment as articulated through legal, regulatory and institutional framework. The ADB has recommended that the government should facilitate more and more private/public partnership projects in order to accelerate economic development.

|

Whilst commending the high economic growth achieved during the last 3-4 years, it is critical to recognise the importance of sharing the benefits of growth among the majority of the people of this country. In fact, President Mahinda Rajapaksa at the launch of the 2011 Central Bank annual report is reported to have said that there is no point in having high growth rates if the people are not enjoying the fruits. Even the opposition members have commended the President for making such a statement at the release of the Central Bank report.

This is a perennial issue connected with economic growth and equality especially when adopting a more liberalised economic policy. Joseph Stiglitz, former Chief Economist at the World Bank and winner of the Nobel Prize for Economics 2001, in his book titled ‘Globalisation and its discontents’ mentioned that, “Globalisation today is not working for many of the world’s poor for much of the environment.” He argued that trickle-down economics was never much more than just a belief.

The conclusion therefore, is that the free market capitalist policies, if not managed properly, are undesirable in terms of achieving true economic development and improving the quality of life of the people. However, much to the credit of “Mahinda Chinthana” policies, there have been commendable achievements in the recent past in dealing with regional disparities.

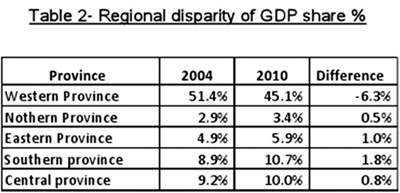

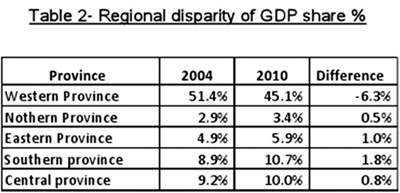

As can be seen from the above table, there has been a gradual decline of the GDP share (from 51.4% to 45.1%) of the Western province to the total GDP. What is more important is that, if we consider Southern and Eastern provinces (as illustrations only) the respective shares have increased from 8.9% to 10.7% for the South and 4.9% to 5.9% in the East. These phenomena, the Central Bank claims, would help to lower the regional imbalances between the Western Province and the other provinces and uplift the income levels of people living in rural areas. The ongoing development projects such as Mattala airport, North-East reconstruction projects, Upper Kotmale Hydro power and proposed Colombo-Kandy-Kurunegala expressway and Jaffna highways should be viewed in that perspective. The days of “Colombata Kiri-Gamata Kekiri” are gone. The Colombians must learn to eat Kekiri than potato chips and it’s good for their health.

(The writer is a regular contributor on economic and social issues) |