Comprehensive Economic Analysis of Deep Water Bunkering Terminal Development + Fresh Water Bundling Strategy at the Port of Colombo – Part 02

By Shashi Dhanatunge –

A former Chairman of Ceylon Shipping Corporation, Director of Ceylon Petroleum Corporation and Vice Chairman of Civil Aviation Authority. Currently holding Board positions in several local and overseas companies

Overview

- Currently, bunker prices at Colombo Port are much higher (+$50/MT) than at Singapore and UAE. The difference can be brought down with the introduction of deep water bunkering terminal. Colombo is expensive overall due to the fuel premium. However, if Colombo’s fuel premium can be narrowed (e.g. $10/MT higher than Singapore instead of $30), the combined cost of bunker + fresh water would nearly breakeven with Singapore.

- The takeaway is that cheap water substantially reduces the total refueling bill in Colombo, though it cannot fully counter very large fuel price gaps. In many realistic cases the bunker price differentials in the region are within a few percentage points; thus, Colombo can use water pricing to neutralize a moderate disadvantage or even achieve a slight overall cost edge. Shipping lines often calculate such total costs when planning where to bunker. By ensuring Colombo’s package (fuel + water) cost is at or near parity with Singapore (and better than ports like Fujairah or Mumbai in some cases), the port becomes a viable and attractive alternative.

- It’s also important to note that fresh water quality and quantity in Colombo would be assured as part of this offer – the water is supplied from the national grid (treated potable water) rather than from uncertain sources. This means ships get not only cheaper water, but high-quality drinking water for their tanks. In Singapore, although water is high-quality, the escalating cost for large volumes might discourage vessels from fully filling their water tanks there. Colombo can encourage ships to take all their needed water without worry about cost. This could slightly increase the volume of water that vessels choose to bunker in Colombo (since it’s inexpensive, a ship might top off tanks more than they otherwise would). That in turn adds to the value gained by the ship during the Colombo stop, further justifying the call.

- In summary, bundling fuel and water makes economic sense for ships when looking at total cost. Colombo’s new strategy would transform water from a costly line item into a negligible expense, effectively sweetening the deal for purchasing fuel in Colombo despite a small premium. The overall cost comparison underlines that Colombo does not need to beat Singapore’s fuel price to win business – it just needs to be close enough that the water bonus tilts the balance.

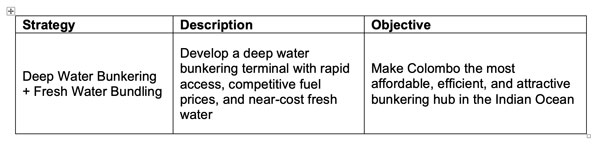

|

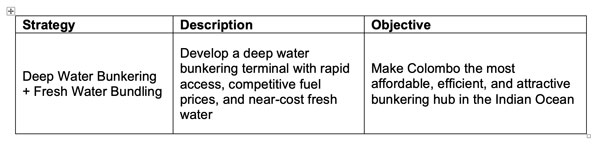

Strategy

|

Description

|

Objective

|

|

Deep Water Bunkering + Fresh Water Bundling

|

Develop a deep water bunkering terminal with rapid access, competitive fuel prices, and near-cost fresh water

|

Make Colombo the most affordable, efficient, and attractive bunkering hub in the Indian Ocean

|

Current vs. Proposed Fresh Water Pricing in Colombo vs. Major Ports

Colombo’s Water Tariffs: The National Water Supply and Drainage Board (NWSDB) sets a standard tariff of Rs. 750 per cubic meter for supplying water to ships (Category 72: “Shipping”) (2398-19_E-water.pdf). Under current practice, the Sri Lanka Ports Authority (SLPA) charges about US$8 per 1,000 liters (1 m³) for fresh water delivered by barge, with a minimum charge of US$75 per delivery. This roughly equates to LKR ~2,400–2,500 per m³ at recent exchange rates – 3 to 4 times higher than the NWSDB base tariff. The proposal is to instead offer water to vessels at the NWSDB’s tariff (Rs. 750/m³) plus only a minimal logistics margin. In practice, this could bring the effective price down to roughly Rs. 800–850 per m³ (≈US$2.3–2.5), a dramatic reduction from current port pricing and very close to the local cost of supply.

Singapore’s Water Pricing: In Singapore – one of the world’s top bunkering ports – fresh water is considerably more expensive, and is billed on a steeply tiered scale. Water supplied to ships from the PUB (Public Utilities Board) mains is charged S$7.35 per 1,000 liters (~US$7.35) for the first 50 m³, then rising to S$8.35 for the next 50 m³, and progressively up to S$21.35 (US$21.35) per m³ for usage above 400 m³. There is also a 20 m³ minimum order (i.e. a minimum charge of ~US$147 per supply) and an added water conservation tax on all sales. These rates reflect Singapore’s scarce freshwater – the port’s pricing incorporates costly desalinated/recycled water and import fees, plus taxes to curb heavy usage.

Other Major Ports: Other key bunkering hubs similarly have higher water costs. For example, Middle Eastern ports like Fujairah or Dubai rely on desalination for potable water, so their ship water prices tend to be on par with or above Colombo’s current US$8/m³ rate (often in the $8–15 per ton range, with minimum delivery fees). European ports (e.g. Rotterdam) may have lower raw water costs than Singapore due to abundant supply, but still charge for delivery and infrastructure, typically a few dollars per ton. In India, ports have decent freshwater availability but historically haven’t leveraged ultra-cheap water as a competitive tool. In summary, Colombo’s proposed Rs. 750+ minimal margin pricing – equivalent to roughly US$2.5–3 per m³ – would make it an outlier low-cost provider of fresh water among major ports.

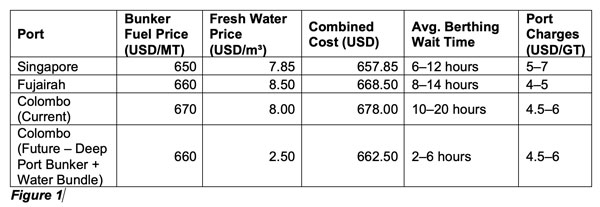

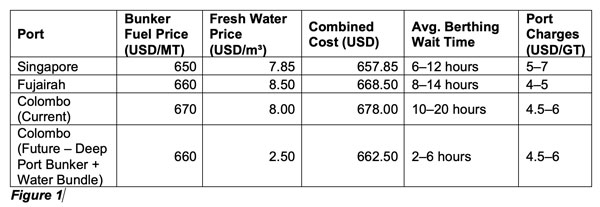

Figure 1: Comparison of fresh water tariffs for vessels at Colombo vs. Singapore and Fujairah along with bunker prices and port charges. Colombo’s current port price (~US$8/m³) is already similar to Singapore’s base rate (~US$7.3 for first 50 m³) ( Supply of Water | Maritime & Port Authority of Singapore (MPA) ). The proposed Colombo rate (~US$2.5) is dramatically lower. Singapore’s tariffs escalate with volume (up to US$21+ for high consumption) due to its scarce water resources and added conservation taxes ( Supply of Water | Maritime & Port Authority of Singapore (MPA) ).

|

Port

|

Bunker Fuel Price (USD/MT)

|

Fresh Water Price (USD/m³)

|

Combined Cost (USD)

|

Avg. Berthing Wait Time

|

Port Charges (USD/GT)

|

|

Singapore

|

650

|

7.85

|

657.85

|

6–12 hours

|

5–7

|

|

Fujairah

|

660

|

8.50

|

668.50

|

8–14 hours

|

4–5

|

|

Colombo (Current)

|

670

|

8.00

|

678.00

|

10–20 hours

|

4.5–6

|

|

Colombo (Future – Deep Port Bunker + Water Bundle)

|

660

|

2.50

|

662.50

|

2–6 hours

|

4.5–6

|

Figure 1

Bundling Fresh Water with Bunker Fuel – Competitive Advantage

Offering competitively priced (or even nominal-cost) fresh water bundled with bunker fuel can make Colombo more attractive to ship operators, even if Colombo’s fuel prices carry a slight premium. Typically, ship owners are highly sensitive to bunker fuel prices – historically, Colombo’s bunker fuel has been pricier than regional alternatives because Sri Lanka imports most of its fuel from hubs like Singapore/Fujairah (Sri Lanka sees positive bunker prospects on pricing economics ...). This has sometimes made ships bypass Colombo for cheaper fuel in India or Singapore. By bundling, Colombo can shift the decision criterion from just “fuel price” to “total cost of refueling stop.” Key points include:

- Offsetting Fuel Price Premiums: If Colombo’s VLSFO (Very Low Sulfur Fuel Oil) is, say, $10–30/MT more expensive than Singapore’s, the additional cost for a typical uplift (e.g. 500–1000 MT) runs into a few thousand to tens of thousands of dollars. However, a large vessel might also take on 50–300 m³ of fresh water during refueling. In Singapore, that water could cost anywhere from $7–15 per m³ (plus taxes), adding several thousand dollars to the bill ( Supply of Water | Maritime & Port Authority of Singapore (MPA) ) ( Supply of Water | Maritime & Port Authority of Singapore (MPA) ). In Colombo, if the same water is offered at near-cost (around $2–3 per m³), the savings on water could amount to several thousand dollars – partially offsetting the higher fuel bill. In effect, Colombo can “give back” value through cheap water. Even though the dollar savings on water are smaller than the fuel outlay, this bundling narrows the net difference. For cost-conscious operators, a bundle discount makes Colombo’s package (fuel + water) competitive with Singapore’s.

- Total Voyage Cost Perspective: Shipping companies consider the all-in cost at a port of call. A slightly higher fuel price might be acceptable if other necessities are cheaper. By bundling fresh water (and potentially other services like lubricants or provisions) at a competitive rate, Colombo adds value that Singapore (with its high water tariffs) does not. For example, a ship planning its refueling could reason: “Fuel in Colombo costs a bit more, but if we top up water and dispose waste there in one go, overall it might cost the same or less than fueling in Singapore and getting water elsewhere.” This one-stop convenience can tip the scales. A ship that might otherwise skip Colombo could be enticed to stop if it can refuel and replenish water in a single efficient visit, knowing the water is a bargain.

- Marketing Edge: Simply advertising “Free/Priced-at-Cost Fresh Water with Bunkers” is a powerful marketing message. It directly addresses a cost item (freshwater) that operators usually have to pay dearly for in other ports. Even if the financial magnitude isn’t as large as fuel, the psychological and practical impact is notable – it signals that Colombo is willing to compete on total service value. This can draw the attention of fleet managers and charterers looking to optimize port calls. In competitive terms, bundling water is a form of differentiation: Colombo isn’t just selling fuel, it’s selling a full refueling service where water comes essentially at cost price (a small perk that others don’t match).

- Mitigating Minor Premiums: If Colombo’s fuel is only marginally costlier (within a few dollars per ton of Singapore’s price), the water bundling could entirely neutralize the difference. For instance, if a vessel needs bunkers worth $300,000 and water for $10,000, and Colombo’s fuel is, say, 2% ($6,000) more expensive, getting water for 70% less might save $7,000+, actually making Colombo cheaper overall. Thus, bundling ensures that as long as Colombo keeps fuel premiums modest, the combined bill is equal or lower than competitors, effectively eliminating the cost disadvantage. (If fuel prices are significantly higher, water savings alone won’t fully offset it, but will still shrink the gap meaningfully.)

In short, bundling turns fresh water into a strategic loss-leader or value-add: Colombo sacrifices the high margin it could charge on water in order to make the overall bunker stop cost competitive. This can attract ships that would otherwise refuel elsewhere. The net gain for Colombo is in higher volume of bunker sales (and port fees), which likely outweighs the “loss” of not marking up water.

Moreover, providing both fuel and water together means ships can avoid an extra stop purely for water. In some cases, vessels might top up fuel at one port and then get water at another (especially if water quality or cost is an issue). If Colombo offers both at once, a ship can save time and scheduling complexity. This enhanced convenience and cost-efficiency strengthens Colombo’s value proposition despite any fuel price premium.

Strategic Fuel Transition Plan (Years 1–10)

- Years 1–2: Commission deep water terminal; grow capacity to 1.5M MT by bundling fresh water.

- Years 3–5: Expand tank farms, introduce Biofuel handling.

- Years 5–7: Implement dual-fuel delivery (VLSFO/Biofuel).

- Years 8–10: Upgrade to Methanol-ready infrastructure.

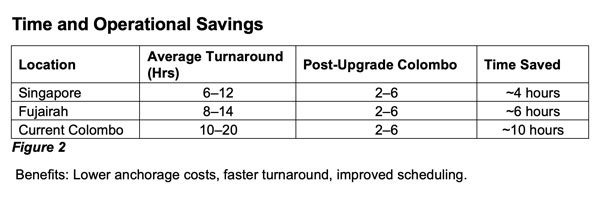

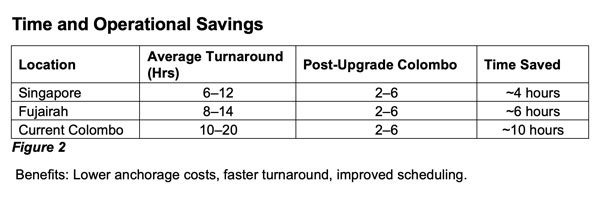

Time and Operational Savings

|

Location

|

Average Turnaround (Hrs)

|

Post-Upgrade Colombo

|

Time Saved

|

|

Singapore

|

6–12

|

2–6

|

~4 hours

|

|

Fujairah

|

8–14

|

2–6

|

~6 hours

|

|

Current Colombo

|

10–20

|

2–6

|

~10 hours

|

Figure 2

Benefits: Lower anchorage costs, faster turnaround, improved scheduling.

Marketing and Pricing Strategies for Colombo’s “Fuel+Water” Value Proposition

To position Colombo as the most cost-effective and service-complete refueling stop in the region, a coordinated marketing and pricing strategy should be executed. Below are strategic recommendations:

- Emphasize the Bundle Deal in Marketing: All promotional materials should highlight that fresh water is provided at NWSDB tariff (Rs. 750/m³) with only minimal handling charges. Essentially, advertise it as “Fresh Water at Cost” or “Complimentary Fresh Water with Bunkering.” This messaging should be front and center in outreach to shipping lines. For example, brochures, port information websites, and advertisements in maritime journals can state: “Colombo – Bunker with us and refill your water tanks at the lowest price in the region.” Such clear messaging will make Colombo stand out in the minds of operations managers plotting bunker ports.

- Targeted Promotions & Incentives: Colombo can introduce incentive schemes to jump-start demand:

- Volume Discounts: Offer additional rebates on bunker fuel if a vessel lifts beyond a certain volume of fuel and water. For instance, “Take >1000 MT fuel and >100 m³ water, get a $5/MT discount on fuel” – effectively returning some value due to the bundle. This encourages ships to maximize both fuel and water uplift in Colombo.

- Loyalty Programs: Implement a loyalty program for ship operators – e.g. every N-th call at Colombo with bunkers + water yields a bonus (such as a waiver of port dues or free freshwater up to a limit). These fosters repeat business and makes Colombo a planned stop rather than an occasional one.

- Introductory Offers: In the first year or two, Sri Lanka could consider an introductory “try and see” offer: for first-time bunker callers, provide, say, the first 50 m³ of water free of charge (absorbed by SLPA as a promo cost). The cost of 50 m³ is only ~$370 (at Rs750/m³) to the port, which is negligible against the fuel sale value, but it creates a strong incentive for new customers to give Colombo a chance.

- Publicize Environmental Angle: A subtle but useful strategy is to frame Colombo’s offering as environmentally friendly or supportive of sustainable shipping. Supplying fresh water from natural sources could be pitched as having a lower carbon footprint than desalinated water (which consumes a lot of energy). If calculations permit, share that by taking water in Colombo (rain-fed reservoirs) instead of from energy-intensive diesel plants, a vessel indirectly reduces carbon emissions associated with its supply chain. This can appeal to companies with green mandates. Additionally, if ships optimize their fuel loads due to the availability of Colombo (not carrying extra weight all the way from Singapore), that improves fuel efficiency and lowers emissions for that voyage segment. While these might be small gains, in an era of ESG (Environmental, Social, Governance) awareness, such narratives can enhance Colombo’s appeal as the smart and responsible choice.

- Consistent Branding as “Most Cost-Effective” Port: All these strategies feed into building a brand for Colombo Port. Over the next decade, Colombo should consistently brand itself as “South Asia’s Most Cost-Effective Refueling Stop” or “Best-Value Bunkering Port.” This identity, once established, becomes a self-reinforcing marketing asset. The fresh water initiative is the keystone of this identity – it’s the unique selling point that gives credibility to the claim of cost-effectiveness. By hammering this message home through multiple channels (advertising, direct client engagement, industry media, etc.), Colombo can cement its reputation. In a conservative industry like shipping, reputation and word-of-mouth are crucial; thus, delivering on promises and then promoting those successfully are key to long-term positioning.

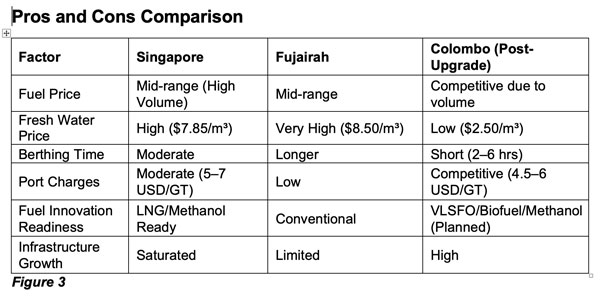

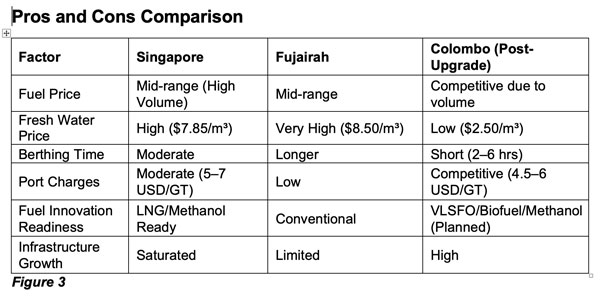

Pros and Cons Comparison

|

Factor

|

Singapore

|

Fujairah

|

Colombo (Post-Upgrade)

|

|

Fuel Price

|

Mid-range (High Volume)

|

Mid-range

|

Competitive due to volume

|

|

Fresh Water Price

|

High ($7.85/m³)

|

Very High ($8.50/m³)

|

Low ($2.50/m³)

|

|

Berthing Time

|

Moderate

|

Longer

|

Short (2–6 hrs)

|

|

Port Charges

|

Moderate (5–7 USD/GT)

|

Low

|

Competitive (4.5–6 USD/GT)

|

|

Fuel Innovation Readiness

|

LNG/Methanol Ready

|

Conventional

|

VLSFO/Biofuel/Methanol (Planned)

|

|

Infrastructure Growth

|

Saturated

|

Limited

|

High

|

Figure 3

Key Takeaways

- Deepwater bunkering infrastructure alone strengthens Colombo but bundling fresh water strategically multiplies the advantage.

- Bunker volumes projected to grow from 500K MT to 5M MT over 10 years.

- Revenue potential exceeds $3.5 billion with a 2.5% net margin.

- Colombo’s low-cost water access creates a bundled advantage over regional hubs.

- The total cost of bunkering + fresh water in Colombo becomes highly competitive with Singapore and Fujairah.

- Faster berth access drastically improves vessel scheduling and operating economics.

- The bundled strategy delivers higher revenue growth, faster payback, and stronger long-term positioning.

- This transformation will position Colombo as the "Indian Ocean's most efficient refueling hub" by 2035.

- Faster berth availability drives higher customer preference.

- Compliments the government’s plan to expand and modernise the oil refinery at Sapugaskanda (SOREM project).

- A liberalised water policy in Sri Lanka Ports Authority shall create long-term port loyalty.

Conclusion

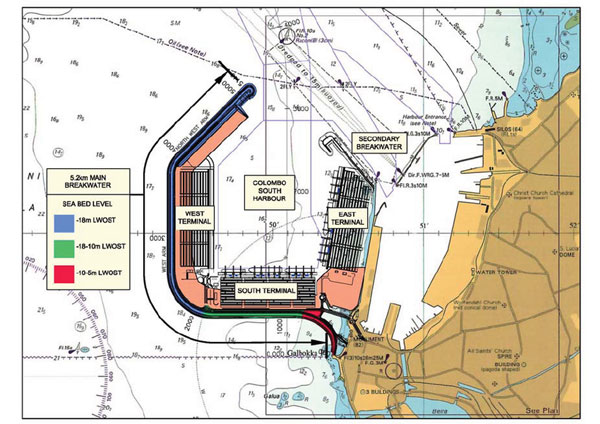

Developing deep water bunkering infrastructure at the Port of Colombo is not only feasible but also economically compelling. Although the required upgrades are capital-intensive, they are grounded in proven models from successful international port projects. An investment of around $125+ million could be recouped through steady growth in bunker sales, especially given Colombo’s strategic location on global shipping lanes. Over a 10-year horizon, the project has the potential to transform Colombo from being purely a container hub into a dual hub for both container handling and bunkering services, unlocking millions of dollars in new revenue streams and significantly strengthening Sri Lanka’s competitive maritime position.

Crucially, the comparison of scenarios shows that not pursuing this project carries a high opportunity cost. With regional competitors like Singapore, Fujairah, and even Hambantota actively capturing bunker markets, Colombo cannot afford to lag if it aspires to be a leading maritime center in the Indian Ocean. By investing in a state-of-the-art bunkering facility — potentially via public-private partnerships to ease the financial burden on the state — Sri Lanka stands to secure long-term economic dividends and enhance national energy security. The Port City development offers an ideal platform to integrate this new oil terminal, complementing and expanding Colombo’s role as a critical logistics and trade hub.

Especially with the new condition introduced by the IMF to its ongoing loan program with Sri Lanka, calling for the abolition of tax concessions currently offered to the investors in the China-backed Port City project, the Government of Sri Lanka (GoSL) shall need to re-strategies its investment promotion programs and also to review how to use the Port City lands productively. Otherwise, the available option is to look at a Single Point Mooring Buoy (SPMB) installed off shore in the Northern end of the Port of Colombo.

Moreover, by adopting smart pricing strategies — particularly using fresh water as a tactical loss-leader and maintaining tight bunker margins — and aggressively marketing its distinct advantages, Colombo can elevate itself as the go-to cost-effective refueling hub in the region. This will require not only visionary initial steps but also an ongoing commitment to customer engagement, operational excellence, and service innovation. With phased execution, strategic partnerships, and continuous refinement, Colombo can realistically emerge as a dominant regional bunkering and maritime services hub, turning what was once a secondary port-of-call into a primary destination of choice for global shipping lines. In doing so, Colombo will not only diversify its port economy but also reinforce Sri Lanka’s broader position in global maritime trade.

Comments

-

Still No Comments Posted.

Leave Comments