The terror of the COVID-19 has reached every corner of the world with more than two million infected cases and 190,000 death tollsat the time of writing this article. Yet, it is unclear when we're going to get to the other side of the tunnel. According to health experts at WHO, the COVID-19 pandemic can last at least for another four months and in the worst-case scenario it could last up to 18 months or longer (The New York Times). Some believe this pandemic could come in three waves (Harvard Business Review). However,as fear continue to rise, Governments around the world are taking drastic measures to contain the impact of the deadly virus. Theyinclude: nationwide curfew, locking downcities, territories and even countries, travel bans and restrictions, imposing new rules and regulations, improving the health care facilities. While these measures are inevitable, the economic and social consequences of such measures are beyond estimate. The disruption over people’s lives, economic activities across the globe is tremendous. The US economic experts have now confirmed an unstoppable recession over the US economy, and this is likely to affect the entire world (Bloomberg). So far, around 22 million job losses have been reported in the US alone. The organizations such asthe International Monetary Fund (IMF), the Asian Development Bank (ADB), and the United Nations (UN)have estimated around $2-4 trillion shortfall in the global income.While all these alarming facts and figures pre-warns an upcoming global recession, we have to ask ourselves, are we ready for an economic meltdown?

This article explores the possible impacts of the COVID-19 outbreak over the Sri Lankan economy and provides implications for vulnerable industries in Sri Lanka.Although there have been few analysis carried out by local institutions and experts on COVID-19 effect on Sri Lankan economy the constant and drastic changes of the COVID-19 pandemic demands more rigorous analysis to be carried out within Sri Lankan context. However, a comprehensive analysis isextremely difficult due to lack of information and unavailability of similar pandemic outbreaks in the recent world history.With the light of previous views and forecasts of the experts around the world, we make an educated guess about the magnitude of the economic crisis that we have to embrace in the near future.

The Global Picture

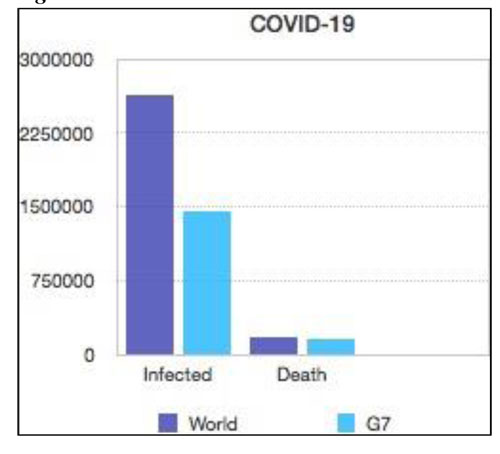

As of now, most countries have imposed full or partial lockdowns and other restrictions on travel and transport in order to contain the spreadof the virus. Nonetheless, COVID-19 sweeps across the globe, and the countries are under tremendous pressure. In particular, the G7 countries, which contribute to more than 30% of the world's GDP, now record more than 50% of COVID-19 patients and around 64% of COVID deaths.This will undoubtedly bring the world economy onits knees. Major industries like oil, airline, entertainments, apparel are facing a historic downturn. The US oil industry, for example, is facing a doomsday scenario as the oil prices turned negative as of 20th April 2020. What is more, the experts warn that some of these companies could disappear at the end of the COVID crisis.

Figure 1: COVID1-19 World vs. G7

But the good news is that China's economy is recovering at lighting speeds where production has accelerated.For instance, the daily production of face masks has increased from 20 million to 120 million.China also has ramped up the manufacturing of other health equipment such as ventilators, COVID-19 testing kits and other essential Personal Protective Equipments (PPE). China's rapid recovery is crucial, as its share of the global economy is higher than most of the Asian countries combined.

That being said, fear of a COVID-19 second wave in China has re-imposed lockdowns in some cities. This adds to the uncertainty about the magnitudeand complexity of the crisis. Besides, the escalation of tension between China and other world leaders including US, UK, Germany, France, and Japan, following the various conspiracy theories about origin of the virus and possible culpability, could bring both world politics and world peace to crossroads. A report that was sent to the UN urges the leaders of the G7 to demand compensation from China for the damage caused by COVID-19 Coronavirus (Express.co.uk). US President Donald Trump has also warned that there will be serious consequencesif China knowingly conceals information about the outbreak (REUTERS). Indeed, it is terrifying to think about the possibilities whatall these will bring tothe world.

Global financial institutions including IFM have been overwhelmed by the loans, loan concessions, and extended pay back periods demanded by poor countries, as the situation has gone from bad to worse.Oxfam International estimated that around half a billion people would be pushed into poverty as a result of COVID-19's impact on the world economy. More than 100 countries have already requested financial support from the IMF under the Rapid Financing Instrument (RFI) and the Rapid Credit Facility (RSF), and the IMF has doubled its ceiling to $100 billion (BROOKINGS).The IMF also stated that the debts of developed countries would increase from $6 trillion to $66 trillion by the end of this year. This will have serious consequences for countries like Japan, where they already have a debt of 200.5% to GDP.

Figure 2: Additional people into poverty due COVID-19

Source: STATISTA

What do we know so far?

The Hardest Hit in The Service Sector

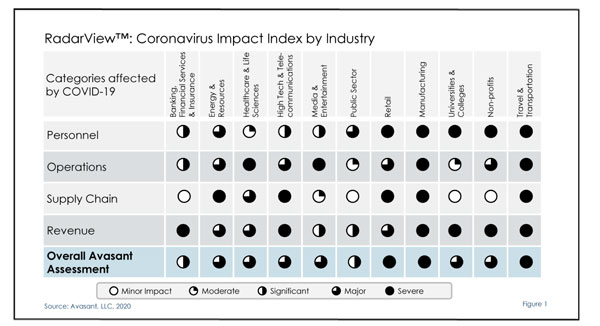

An ‘Impact Index’ developed by Avasant, a leading U.S. management consultancy firm, hasidentified the numerous industries with varying level of impacts from COVID-19 pandemic (Figure 3). According to this index, most industries will have an above-significant impact. The service sector, which accounts for about 60 per cent of the GDP in Sri Lanka, comprises most of the industries that are likely to be seriously affected by the pandemic. The service sector includes, among others, tourism, travel, transportation, retail, health, telecommunications, education, banking, financial services and insurance.

Amongst them, the hardest hit will be uponthe tourism sector that was recovering from the Easter Sunday Attack on 21st April 2019. The arrival of international tourists plummeted after the attack but had a gradual increase by November last year. The continued second hit on the tourism industry has shut down the Sri Lankan tourism industry and a similar impact is recorded globally. World-wide travel bans, movement restrictions, cancellation of visas and not issuing of visas has pushed the tourism industry to the wall. The tourism sector contributes for about 5 per cent of the Sri LankanGDP and provide around 388,500 of direct and indirect jobs. The foreign exchange earning was well above $4 billion in 2018 and however that had been dropped to $3.6 billion in 2019 as a result of Ester Sunday attack. Indeed, with present global pandemic all these earnings and jobs are at stake in coming months. The decline in tourism revenue could be expected around $400-600 million and if the spread of COVID-19 persist, this figure will be even higher. A loss of large number of jobs, about 50 percent,canalso be expected in the worst-case scenario in the tourism sector alone, the industry warns. The decline of the tourism sector also has a significant effect on national income, as the tourism sector is the third largest source of foreign exchange earnings.

Figure 3: Coronavirus Impact Index

Source: Avasant, LLC, 2020

Travel and transport sectors are being severely affected by the COVID crisis. With the current measures taken to contain the virus, all travel and transport have come to a complete halt, with the exception of essential services. The global aviation industry, which accounts for2.7 million employeesand $750 billion revenue, is now facing the biggest crisis ever in its history. Almost all passenger aircraft have been grounded, and some of the airlines have already begun massive layoffs, pay cuts and holding of salaries (Business Insider). Experts estimate that about $113 billion revenue could belost, and this will continue to grow with extended lockdowns, curfews and travel restrictions (CNN Business). In Sri Lanka, the transport sector is one of the largest contributors to the GDP generatingaround $10 billion annually and employs about half a million people. In early February 2020,ADB has estimated that the contribution of the transport sector to the GDP may drop by 0.617 per cent and sector employment may also decline by the same percentage in a worst-case scenario. However, in our opinion, this would be much higher with further escalation of COVID19 crisis, which wasnot expected in early February when the ADB was making their predictions.

During this dire situation, wholesale and retail sectorswilleither benegatively or positively affected. The sales of non-essential products will be drastically reduced, while the sales of essential food and beverage, pharmaceutical products, and personal care products are on the rise as the people rush to stock up on these items in large quantities with panic buying. As a result, these different industries will have varying degrees of impact during this COVID-19 crisis. Needless to say, fashion retailers in Sri Lanka have been one of the worstaffected by the pandemic, as the country was in lockdown during the shopping pinnacle New Year season.The situation for these retail businesses is further exacerbated with the import restrictions imposed by the GoSL on non-essential products. Taken together, the decline in the wholesale and retail sectors will have a significant impact on the country's GDP. The present contribution of 11 per cent from the wholesale and retail sectors may fall by 0.161 per cent (as estimated by ADB). In the worst-case scenario, employment in the sector may also fall by 0.078 per cent.However, it is highly unlikely that the downturn in the sector would be consistent with these predictions.

It goes without saying that there is a heavy burden on the health sector, especially on the public health sector. There is a great danger in the event of an out-of-hand outbreak increasing the number of patients, which exceed the existing healthcare facility.Luckily, it seems Sri Lanka is managing the situation quite well. There is also concern about the shortage of medical supplies, as the main suppliers, such as India and Pakistan, are taking strict measures (export restrictions, lockdown, curfew) to combat the virus.

Industry Sector on Standstill

The industrial sector is among the most severely impacted sectors by COVID-19, with manufacturing and export-oriented enterprises are at the forefront. Disruptions in the supply chain coupled with quarantine and travel restrictions on workers have brought the entire operations in the factories to a screeching halt. The Sri Lanka ‘Purchasing Managers’ Index’ (PMI) has shown the all-time low index value of 30 as of March 2020. This could be further dropped if curfew and other travel and transport restrictions are extended beyond April, 2020. With the rampage of COVID-19 across major export destinations such as the US, UK, and Europe the textile and apparel sector has shrunk in demand. A loss of $1.5 billion in revenue is expected in textile and apparel sector during May to June 2020. That's not all, the companies are sketching massive lay-off plans, and this will ultimately lead to protracted unemployment in the country.Even if the crisis comes to an end, it is unlikely that the textile and apparel sectorsjumping back to the pre-crisis state as soon as we expect, due to the COVID10 impact on large economies like UK, US, Italy and Spain)and it is long way off for them to come to new normal.

As every cloud has a silver lining, the situation is not without benefits. The global prices of crude oil and raw materials are falling. However, it is unlikely that Sri Lankan companies could benefit from this as the value of the Sri Lankan rupee is being heavily depreciated. On the other hand, both global and local Air Quality Indexes (AQI) has reported record breaking healthy figures with the complete shutdown of 24-hour working factories. As a result, the work force is rejuvenating with fresh air, away from toxic cities.

The Great Shift Towards the Agriculture Sector

Agriculture is the nation's lifeline. It plays a crucial role in the economy, not only providing raw materials for other industries, but also providing employment opportunities for a large number of the population. More Than quarter of Sri Lanka's labor force is engaged in agriculture-related activities. Despite the decline in its contribution to the GDP over the years, agriculture remains as themost important sector of Sri Lanka's economy.

Althoughmany believes the impact of COVID-19 on the agriculture would be minimal, it is not that agriculture is of no concern. As Zippy Duvall, President of the American Farm Bureau Federation, warns “Empty Shelves are frightening, but empty filed and barns would be devastating”.

COVID-19 could disrupt farming activities on many levels. High fluctuation in market prices will end up either with surplus or deficiencies. Recentlyin Sri Lanka, there has been bottlenecks at the main economic canters as the farmers rush to sell their harvests. There is also concern that the large gathering of famerscould ultimately lead to the spread of the virus to rural communities. The spread of COVID-19 will be more critical for the farming population as the majority of the population is relatively older. Most studies have shown that the older population is more vulnerable to COVID-19 and has a high level of severity for those aged 60, 70, and older.

With transportcurbs, there is also a likelihood of slowing down the movement and availability of essential items, such as fertilizers, fuels, and other inputs.

The impact on other commercial crops, particularly export-oriented crops such as tea, rubber and coconut, will be noticeable. We have already seen a slight drop in tea export. Fortunately, the leading buyers of CeylonTea (Iraq, Turkey and Russia) have not yet been much affected by the COVID-19 crisis. However, the situation could go completely upside down in the coming months. Since last week, the Colombo Tea auction has gone online, but the absence of certain traditional and major players has been noticeable.

Thanks to the present government, paddy farmers have been assured of a considerable high price for their harvest during this crisis even though the end consumer is unfavourably affected.

However, the coming months are crucialfor paddy farmers both in Sri Lanka and Asian, since the next planting season will range in between May to August. Restrictions on labour mobility andtransportation may compromise farming activities. There also possibilityof changes in farmers’behaviour due to the fear of COVID which may limit the planting capacity. In the worst-case scenario, if the COVOD-19 is spread to leading paddy production areas like North Central, Eastern and Uva Provinces, we can expect a drastic decline in rice production too.

Fiscal Burden and Budget Deficit

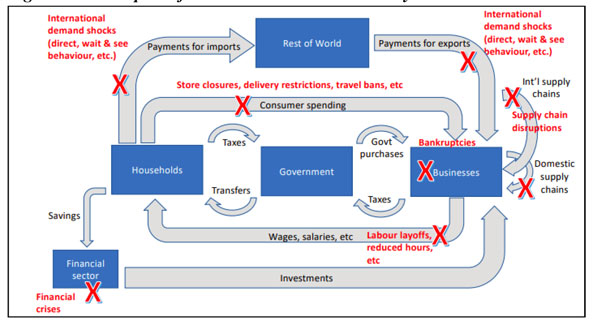

Pandemic as opposed to other crises (i.e. financial crisis, terror attacks) come with several shocks in one blow. The pandemic primarily triggers health crisis and results in economic, social and perhaps political problems.This might cause the government an unprecedented financial burden.

The COVID outbreak creates demand and supply shocks, leading to a huge contraction in the economy that will inevitably reduce government tax revenue.The impact of COVID-19 on the Sri Lankan Government's revenue will be more pronounced as the Government has already introduced a massive tax reduction of around Rs.500 billion following presidential election last year. This impact has been further amplified by restrictions on imports and reduction of the prices of essential goods, which reduce tax revenue.

The situation could be worsened in the event of bankruptcies and an increase in unemployment which reduces household income. In such situations, not only does it reduce government revenue, but also the government must provide economic relief packages to sustain the business and to mitigate job losses. Additionally, moratoriums offered for the industry over the debts and interest of debts will further pressurise the fiscal sector. Granting Rs.5000.00 per household is a timely need, but how long can the government bear this expenditure is questionable. A definite inflation is way ahead if the government choose to print the money to cover their concurrent expenses.

The net effect low tax revenue and the high level of government expenditure could further widen the budget deficit.

The complex mechanism through which COVID-19 effect on theeconomy is depicted in Figure 4.

Figure 4: The impact of COVID crisis on the economy.

Source: A VoxEU.org Book

Is there a way out of an Economic Downturn?

The above analysis warns us on an inevitable short-term contraction in the economy and we should be prepared for the consequences. At this time, the most important thing for the government is to contain the spread of the virus to the communities. Thanks to the entire health service community, military personnel, and others, the spread has been controlled to a certain extent.

The long-term economic impact of COVID-19 could be minimized by taking the right policy decisions. The potential economic losses could be minimized through proper coordination of economic, social and political mechanisms and implementation of proactive policy measures. We suggest following measurements to be taken to minimize the probable economic melt-down and to revive the economic nerve sectors in Sri Lanka:

To the general public

1. Appropriate health measures (Social distancing, regular hand wash, wearing face whenever necessary, motivating stay home, and boosting mentality) and continuous monitoring;

2. Continued public awareness of the seriousness of the virus;

3. Public paying their fullest corporation to the government and the health authorities by strictly adhering to the health measures that have been put in place;

4. Minimizing unnecessary consumption of goods and services and over consumption;

5. Avoid storing essential goods since it creates an artificial demand that leads to both shortage of essential goods (temporarily) and inflation;

6. Adopting ‘home agriculture’ culture to support a sustainable agriculture economy.

To the authorities

1. Effective coordination of personnel and facilities, particularly in the health sector, and ensuring timely availability of the resources required;

2. Ensuring the public well-being by taking various measures, including price reduction of essential food, financial donations to low-income families, wage subsidies, and easy access to health care facilities;

3. Implementing necessary policies to ease the financial burden on the public by introducing relief packages for personal loans, leases and credit card payments, extensions of payment for utility bills, etc.;

4. Imposing restrictions or limits, where appropriate, on imports;

5. Introducing new policies to promote domestic production and agriculture sectors;

6. Encouraging local inventors and entrepreneurs;

7. Supporting the MSMEs through continued debt moratoriums, quick access to capital loans, reduced interest rates, and tax relief;

8. Increasing the liquidity of banks and non-banking financial institutions, particularly those lending to MSMEs through the intervention of central banks;

9. Offering temporary and tailored loan guarantees to the companies with short-term liquidity needs;

10. Demand should be lifted through broad-based fiscal stimulus once the economy begins to normalize;

11. Increasing the ties with more stable and less affected economies in the region and in the world and look at alternative export oriented industries;

12. Consider some unconventional strategiessuch as direct unrepayable funding known as “helicopter money” by the central bank.

Irrespective of the pandemics, terrorist attacks and other calamities people have to live and people will live. However, these catastrophic evets remind people to rethink oftheir priorities. COVID19 is on the other hand a very tough teacher to learn from: you either learn and survive or miss and suffer. An ‘economic paradigm shift’ is also at hand to deal with (we wish to discuss the same on a separate article). However, with the lessons learnt, after combating this challenge against the entire human race, we will rise again stronger and harder in a new eraof humanity.

Writers:

PR Weerathunga and WHMS Samarathunga

PhD Scholars in PR China and Senior Lecturers at Faculty of Management Studies, Rajarata University of Sri Lanka. The authors can be reached through: weerathungaroshan@gmail.com, manoj.susl@gmail.com

Leave Comments