URGENT PLAN TO MITIGATE COVID-19 IMPACT ON SRI LANKAN ECONOMY - CONCEPT PAPER

Ranjith J Wickramasinghe. FCMA (UK), FCCA, ACC.Dir.SL, CGMA

The author is an independent financial advisor and a consultant, and was the former Chairman – Sri Lanka Ports Authority & Ceylon Shipping Corporation.

Contactable via email at: ranjith_wickramasinghe@ymail.com

1) Loss of Foreign Exchange Earnings

Sri Lanka will lose about US$16 Billion (Bn) in foreign exchange (FE) earnings for 2020 due to the

COVID-19 global pandemic. This is equivalent to about 20% of our Gross Domestic Product (GDP).

- The COVID-19 pandemic resulting in a global lockdown virtually disabled Sri Lanka’s leisure sector earnings of US$4 Bn per annum (pa) from foreign tourists.

- Apparel exports earning US$5 Bn pa, has stopped due to a fall in global demand.

- An estimated reduction from expatriate remittances by about US$3 Bn pa (40% reduction from 2019).

- An estimated reduction in other exports and services by about US$3 Bn.

- Capital flight out of Colombo Stock Exchange (CSE) of about US$ 1 Bn.

It is envisaged that other sectors of the economy will recover gradually with the stimulus measures already taken by the government, and this paper largely addresses action needed to arrest the decline and strengthen our external economy as summerised below, and details of which, given in the annexure, referenced under remarks. Diversification suggested will also simultaneously strengthen our rural economy.

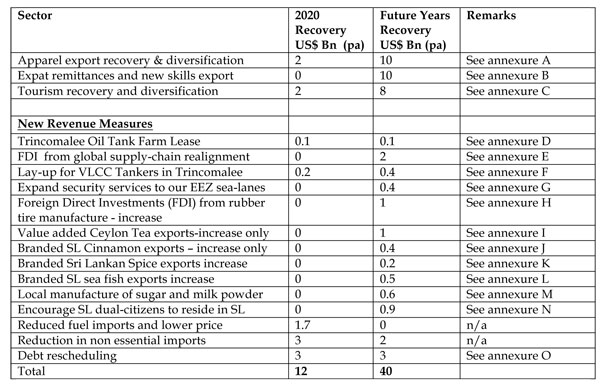

2) Proposals to Mitigate Foreign Exchange Loss (Targets)

3) Deficit Funding required for 2020 (US$16 Bn Loss – US$12 Bn Recovery = US$ 4 Bn.)

SL whilst having handled COVID-19 containment well, has also taken internal measures to

resuscitate the economy. It needs the support of the Foreign Countries and Multilateral Agencies to

provide SL with a relief funding package of US$ 4 Bn immediately to cover our deficit.

4) External Reserves

It is essential that our external reserves are maintained at the present level of US$ 7 Bn.

2

5) Additional measures required to stabilize the economy in the short and medium

term.

A. Usage of SL Exclusive Economic Zone (EEZ), sea lane and air space by foreign carriers. SL has a largely unshared EEZ of 200 nautical miles in the Indian Ocean, (517,000 km2) which is almost nine times our land mass. Foreign carriers comprising of 45,000 aircrafts, 30,000 cargo ships and 4500 super tankers used our EEZ maritime zone and air space, polluting our environment during 2018.

Sri Lankan flag usage in aviation and shipping is minuscule (0.01%) compared to what the foreign carries used our zone. SL must be rewarded for the benefit accruing to the foreign countries, saving on daily operating costs (DOC) and fuel for the reduced travel time, and also the additional revenue earned on reduced voyage time, estimated at US$ 10 Billion annually, based on above data. (Value given is subject to further review)

Based on the above crossings, foreign carriers are estimated to have polluted our land and EEZ seas to the tune of CO2 emissions of 10 Million tons. CO2 emissions of Sri Lanka as per world Bank was reported as 18 Million tons in 2016, compared to the world pollution at 36,000 Million tons. It is proposed that SL Government canvass with foreign countries, world bank, UN, etc to exchange /write off our foreign debt now standing at US$ 60 Billion against the benefits accrued to foreign countries on EEZ crossings and as compensation for the pollution caused in our land and EEZ waters in the past two decades.

B. Petroleum and Gas

Petroleum, gas, fisheries and aquatic resources in our Exclusive Economic Zone which has been mapped out, must be urgently documented, and measures taken to utilize same for the sustainable growth of the nation.

It has been estimated that the Mannar basin, Karveri and Lanka basins has the potential to meet the fuel and gas needs of SL for 60 years. SL spent net US$ 4 Billion in 2018 for import of fuel and gas recording a potential benefit of US$ 240 Billion.

C. Refocusing of Strategic Investments

SL has made some strategic investments into the Colombo Port City, Hambanthota Port, Maththala Airport, Colombo Lotus Tower and the New South Port of Colombo, where substantial benefits to the economy could be harnessed immediately. (Potential benefit estimated over US$ 1- 2 billion per annum) D. SL is acting as a carbon sink - we can trade/exchange the carbon credits earned.

SL being an island with a large green cover is acting as a sink absorbing carbon produced by SL of 18 tons, and 10 tons off loaded by foreign carrier crossings? It is estimated that SL absorbed ....... tons of CO2 in 2018 (Value to be ascertained). A mechanism must be put in place in the future to compute the credits earned and the government should negotiate a scheme for settlement with the international agencies.

E. Infra-structure Investments

Foreign Funded Infra-Structure Investments must be persuaded to use maximum local labour and inputs, local sub contractors in order to stimulate the stalled economy. (Benefit over US$ 1 Billion) F. State Owned Enterprises (SOE)The largest fifty four SOE’s with an asset base of Rs Billion 8,200 (Rs Bn) equivalent to US$ 85 Billion paid Rs. Bn 20 as Levy/Dividends in 2018 excluding the TRC levy of Rs Bn 22. The Banking & Insurance sector with an asset base of Rs Bn 5,800 paid Rs Bn 12 (0.002%), and other SOE’s with a asset value of Rs Bn 2,500 paid Rs Bn 9 (return on asset value 0.0036%). SOE performance has further deteriorated in 2019.

3 SOE’s must be restructured and Financial targets given to each SOE immediately to at least recover the

Government Subsidies of Rs.200 Billion given annually to Samurdhi, Fertilizer, Senior Citizens, etc.

6) Administrative measures required

A) Government should address immediately the perennial problems experienced by the farmers – water, fertilizer, pesticides, elephant fencing, damage from pests, importation of cows and arrangements for sale of crop.

B) SME sector contributes to a substantial portion (50%) of our GDP. They are struggling to restart after Covid-19, as relief offered is conditional on co-lateral security, which most lack. All Commercial Banks must engage directly with the small entrepreneurs, provide them “development banking support” needed via a dedicated officer at each branch under a safety net and guidelines to be provided by the Central Bank, Sri Lanka.

C) Give priority to generation of energy from renewable sources, lowering pollution.

D) As per tradition SL should continue the Non alignment policy in geo-politics, maintaining close relationships with India, China, Pakistan, Britain, Japan, Russia, USA, EU, Gulf, Australia, S/Korea, Singapore, Malaysia, Nordic countries, Canada, Iran, Iraq, South Africa, Kenya, Tanzania, Brazil, New Zealand, SAARC, BIMSTEC. Broader inter – governmental cooperation will be helpful for SL to get Global support to restart the economy devastated by COVID19.

7) URGENT FOCUS

Ministry of Finance Annual Report 2019 has noted that the actual budget deficit for 2019 would go up

from the reported Rs.1,016 Billion with the inclusion of all “unpaid claims” previously incurred. This, in effect amounts to an increased deficit of a further 2.2% of GDP, bringing the deficit to a total of 9% of GDP from the reported 6.8%. This is a serious aberration on nation’s financial discipline, and pushing SL debt to over Rs.14,000 Billion, reducing our GDP to US$84 Billion (US$3,852 per Capita), and slowing SL’s to growth to 2% in 2019. Intervention of the President and Prime Minister heading a task force (as COVID19 situation was controlled), to reinforce financial discipline and implement above urgent measures to mitigate the impact on our economy is timely.

This concept paper has been formulated by:

URGENT PLAN TO MITIGATE COVID-19 IMPACT ON SRI LANKAN ECONOMY - CONCEPT PAPER

Annexure

A) Apparel Exports US$5 Bn loss – Recovery & Diversification

Pending the return of the demand for the high value apparel contracts from overseas brands and

markets, the government should assist the apparel sector to immediately shift to supply the massive

global demand for the personal protective equipment (PPE), also assist them to cater the local demand for

uniforms - tri forces 1 million personnel, schools 4 million students. It is anticipated that the Apparel

exports will partially recover during the second half of the year.

It is proposed that the apparel sector move to backward integration, with the manufacture of fabrics and

other accessories needed for the local market, and extend gradually for exports. During 2018 SL has spent

US$3 Billion on import of garments and textiles. Government must provide necessary support.

Much of the apparel factories are situated in the rural areas, the government can use their rural presence,

knowledge, human resources and organization structure to redeploy them profitably into commercial

food production, distribution and wholesale. They can then establish a new branding, and export as well.

They also could make arrangements buy the current rural farmers produce at guaranteed prices and,

properly package the perishable items to minimize damage during transportation to the markets. This

will then increase the rural household earnings, give them stability to continue their living and farming.

This will assist in the rural economy, prevent migration to urban areas and provide food security to SL.

The present value addition in vegetables and fruits is well now over 200% from farm gate to retail price.

Ethically the margin could be kept below 100% thus giving the farmer, investor and the consumer a

better return. Returns on exports will be substantially higher; potential is estimated over US$ 5 Billion.

It is possible to substantially reduce the transport cost by using the underutilized CGR capacity, and also

reduce damage to perishables with proper transport packaging, which now exceed 30%.

Apparel sector should be assisted to research into making fabric from Plantain trunk and leaves that are

going waste in large quantities, in the farming areas. Potential is unlimited being organic.

Apparel sector also can be requested to reinvest into the manufacture of rubber gloves to cater to the ever

increasing overseas demand in PPE from our rural natural rubber, potential is US$ 2 Billion.

B) Expat Remittances US$ 3 Bn loss – New skills

Since Covid-19, every country will strengthen their medical structure recruiting extra medical personnel.

SL should quickly initiate procedures to teach, train, test and award certificates to those categories of

medical staff to cater to this international demand. We have the expertise in this area & other

disciplines, and SL could quickly regain the lost US$ 3 Billion FE from expat remittances.

C) Tourism Earnings US$4 Bn loss – Recovery & Diversification

Sri Lanka was voted as the best tourist destination globally attracting 2.4 million tourists annually,

mostly from India, China, UK, and Europe. The hotels should be assisted immediately by the Tourism

Promotion Authority to get back their repeat clients in time for the next season commencing in August.

Potential US$ 0.5 Billion (10%).

The global tourist market of 1.4 Billion had totally collapsed and will take time to improve. SL market

share was miniscule at 0.17%, and the government should aggressively promote SL cutting edge in

destination, activities, bio diversity, ancient culture, hospitality, spirituality and highlight the assistance

& care provided to foreign Covid-19 patients by SL during the pandemic, in order to get back a good

portion of our markets soon as possible. Potential recovery - US$ 1.5 Bn in 2020.

The global needs will change from holiday travel &leisure to medical care, prevention of sickness,

wellness and spiritual wellbeing. Presently under utilized Leisure and Hospitality industry should be

assisted by the government to gradually diversify into new areas suggested below.

5

Some of the hotels have already been offered to the government to be used as hospitals and quarantine

hotels; this idea must be pursued further to expand the government medical facilities. Hotel owners

must be compensated properly. SL had an inventory of 40,000 rooms operational and much more under

construction.

SL has spent US$0.5 Billion on import of Pharmaceuticals in 2018. This is another medical curative area

for the leisure sector to think about reinvesting and later expanding to exports.

The hotels also have the expertise to produce organic fertilizer, recycling their waste, etc. They could use

their knowledge to making organic fertilizer; SL had imported chemical fertilizer for US$262 million in

2018. SL government provides 500,000 tons of fertilizer for paddy farmers virtually free, this is a captive

market. The government should assist the hospitality industry to diversify into organic fertilizer.

The experts are of the opinion that SL soil has been polluted with chemical fertilizer and pesticides over

the years, and an urgent policy shift is necessary to promote organic fertilizer and reducing chemical

fertilizer imports and pesticides over a period of time.

Hotels should also be encouraged to invest into renewable energy from rurally grown bio-mass, paddy

husks and solar. Recycling of plastic is another area to diversify into. Potential savings: US $1 Billion.

Our hotels are located surrounding coconut trees, and the government should encourage the hotels to

invest into coconut development and export of value added products with Branding which now have a

high demand as SL virgin coconut oil is now considered as a curative medicine. Export potential is

substantial, perhaps US$1 Bn.

D) Opportunity to Lease Trincomalee Oil Tank Farm

Announcements have been made that due to fall in demand for fuel in USA their crude oil storage

facilities are over flowing. Though USA crude production has been curtailed, yet the contracted Saudi

supplies will continue. This is an ideal opportunity for SL to Lease out our unused oil storage tanks in

Trincomalee that have a storage capacity of 1 million tons. The government should actively pursue this

new business. Potential: US$100 million/annum.

E) FDI Opportunities for SL in the Realignment Process of the Global Supply Chain.

Announcements have been made by USA and Japan to relocate their supplies now obtained from China

to other countries. The other countries too will re-align some of their supply chain requirements. SL

government should vigorously canvass with USA, Japan, and other countries to have these

manufacturing units located in SL.

We should also discuss with China to relocate some of their operations as Joint ventures in SL to broad

base their supply chain. We could increase our FDI’s substantially and provide employment and give our

economy a kick start. Potential FDI: US$2 billion/annum.

F) Opportunity to lay-up/park excess Crude oil carriers at Trincomalee Harbour.

The world consumption of fuel has been drastically reduced due to Covid19 pandemic, and the crude

prices have fallen to dangerously low levels. Very soon there will be a requirement to lay up a substantial

portion of world crude tanker tonnage. The government should canvas for our underutilized

Trincomalee harbour, which has the deepest depth in the world, and capacity to lay-up or park the Very

Large Crude Carriers (VLCC) tonnage, owned by any country from which SL could earn substantially in

Forex.

G) Expand Security services to sea lanes in our EEZ

The government should expand the services to earn more FE for SL. (potential US$ 0.4 Bn)

6

H) BOI should canvas FDI’s to expand the manufacture of high value tires and rubber

products for exports from SL natural rubber– increase exports from US$1 to 2 Bn.

I) Ceylon tea is ranked the best in the world, also has powerful properties to fight

infection, etc. – Double the value added exports from current US$ 1 Bn.

The Ceylon Tea Board should assist the tea exporters to increase the value added sales portion, (at

present which is 10% by volume) substantially, from the current levels earning much needed FE for SL.

J) SL Cinnamon is the best in the world – create a brand and promote value add exports

Government should assist the cinnamon growers to venture into the branded value added exports as it’s

now largely shipped in Bulk form and susceptible for adulteration with cassia produced elsewhere.

K) SL spices have a high quality.

Our Pepper and other spices are of a unique & high quality, assist the exporters to create a brand and

promote value added exports.

L) Government should assist in optimizing the use of our EEZ for fish and seafood

exports – immediate potential US$ 1-2 Billion.

M) SL imports sugar and powdered milk spending US$ 600 million per year, these must

be locally produced, further strengthening the rural economy.

N) Lots of Sri Lankan dual citizens residing in other countries have made inquiries to

return home after Covid-19 experience. The Government should seize this

opportunity, as 50,000 returnees each spending US $1500 per month, could bring in

US$900 million per year.

O) Debt Rescheduling

SL had to Lockdown due to no fault of ours, but to prevent the Covid-19 that was transmitted to SL from

overseas, and prevent further spreading accordance with advice from World Health Organisation

(WHO).

With the lockdown our earnings had collapsed, compelling us to reschedule our international debt. It is

suggested that we propose to reschedule 90%of 2020 loan repayment except the International Sovereign

Bonds, 75% of 2021 loan repayments, 50% of loan repayments of 2022, and 25% of loan repayments of

2023, and payable at concessionary rates of interest, with a moratorium of three years over 20 years. The

government should engage with the WHO, IMF, World Bank and donor countries to peruse this urgent

exercise. The estimated FE saving for 2020 would be about US$3 Billion.

P) Requests for Covid-19 Relief funding in 2020

SL should also request from the World Bank, IDA, IBRD, ADB, BRIC reconstruction bank, China Exim,

China Reconstruction Bank, JICA, etc., for covid19 relief funding to cover to the deficit of US$ 4 Billion.

June 10th, 2020

-

Still No Comments Posted.

Leave Comments