Significance of the Central Bank proposition

By Kajanga Kulatunga

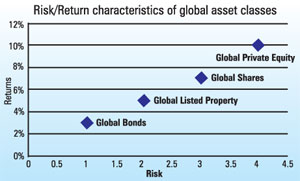

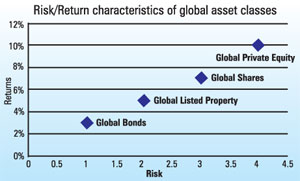

Figure 1: Sample Risk/return profile of some common asset classes. Data has been generated by the author for illustrative purposes only. |

Investors should gladly welcome the Central Bank proposition announced earlier this week to allow Sri Lankans to invest in overseas shares and bonds. The benefits of investing globally are countless. Chief amongst these is the ability to diversify risks by holding a basket of global assets, across a range of asset classes, industries and countries.

Diversification is the cornerstone of any sound investment strategy. Simply put diversification is about not putting all your eggs in one basket. In investment parlance, diversification is build by combining uncorrelated or negatively correlated asset classes. That simply means building a portfolio combining different assets that theoretically and historically move in opposite direction.

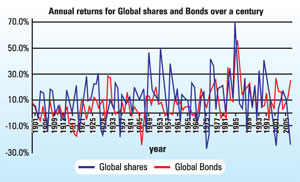

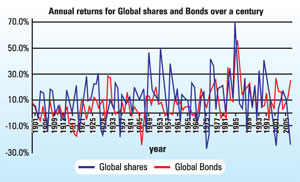

This helps protect your capital as the fall in value of one asset is offset by the rise or stable returns from another. The classic mix is between bonds and shares. Usually, given the very different characteristics of these two assets, bonds tend to react differently to shares during various economic cycles. Property is also a unique asset that sits between bonds and equities in the risk/return spectrum. So called “alternative” assets are mostly marketing gimmicks with very little benefit to the average investor.

However, there are times when diversification seems to come unstuck. The global meltdown after the collapse of Lehman Brothers in 2008 was a classic example. Every asset class was equally battered. A closer inspection reveals that the benefits of diversification remained intact, and it was the individual portfolio mix that actually failed investors.

Figure 2: Shows the annual returns from Global Shares and Bonds over the last 108 years. This graph has been created by the author using multiple sources. |

Offshore exposure helps in overall portfolio diversification as Sri Lanka is a very small part of the global economy and global capital markets. There are entire industries (such as Aerospace and Defence) overseas that are not available in Sri Lanka, which provide great opportunities to investors.

Investing offshore however attractive is not without risk. Foreign exchange risk is the most obvious. Your investment return from overseas is partly dictated by the return on currency as well. Fund managers provide various methods of ”hedging” currency in many markets, which helps remove much of the volatility associated with currency risk. Basic risks associated with any investment also do not go away, simply because they are global. Prudence and due diligence should still be an essential component in selecting a good investment strategy.

What investors now need are a few good fund managers to establish distribution arms in Sri Lanka to help ease access to global markets. The current local infrastructure for someone who wishes to invest overseas is sparse and expensive. Investors should be well served by the advent of some low cost basic index funds to begin with. The investment prospects for the average Sri Lankan never looked better.

(The writer is an Investment Specialist based in Sydney, Australia. He can be contacted via kajangak@gmail.com). |