The success of the Chinese economic reform program needs no underlining. In just 30 years it has gone from state ownership and central planning; to an economy that is the world's second-largest economy and challenging that of the USA. But how did it start, and what has Sri Lanka to do with it?

It is well recognised that the market reforms were initiated by Deng Xiaoping, which has earned him the reputation as the "Architect of Modern China". Following Mao Zedong's death in 1976, Deng became the de facto leader of China in December 1978; inheriting a country beset with social conflict, disenchantment with the Communist Party and institutional disorder resulting from the chaotic policies of the Mao era. Deng went on to lead a change of direction for the Chinese Communist Party, advocating ‘personal responsibility’ for villagers who could now sell their produce on the market, and supporting free markets, foreign investment and private ownership—none of which had been allowed during Mao’s Chairmanship.

In a ground-breaking speech in 1984, Chairman Deng said that… “The fundamental task for the socialist stage is to develop the productive forces. One of our shortcomings after the founding of the People’s Republic was that we didn’t pay enough attention to developing the productive forces. Socialism means eliminating poverty. Pauperism is not socialism, still less communism …”

He continued that… “The present world is open. One important reason for China’s backwardness after the industrial revolution in Western countries was its closed-door policy. After the founding of the People’s Republic we were blockaded by others, so the country remained virtually closed, which created difficulties for us. The experience of the past thirty or so years has demonstrated that a closed-door policy would hinder construction and inhibit development …”

This speech gave the green light for market-economy reforms; and the Communist Party authorities carried out these reforms in two stages. The first stage, in the late 1970s and early 1980s, involved the de-collectivization of agriculture, the opening up of the country to foreign investment, and permission for entrepreneurs to start businesses. However, a large percentage of industries remained state-owned.

Further, the entrepreneurs who did manage to start businesses mainly concentrated on selling to domestic markets. They had very little idea of how to market internationally, and even the fundamentals of exporting and international commerce was a mystery to them. Recognising this, in late 1989; the Shanghai Branch of the Economical, Technical and Social Development Research Centre of the International Technology and Economy Institute was asked by the State Council of the Peoples Republic of China to source foreign experts to advise Chinese entrepreneurs and senior officials chosen by the State Council on the intricacies of a market-economy; with a view to privatizing and contracting out of much state-owned industry.

One of the experts chosen for this task was Australian Professor John Dixon, an economist specialising in China. Professor Dixon asked Sri Lankan-Australian Professor Janek Ratnatunga to join him on this project. The pair made a good team. Professor Dixon had intimate knowledge of both macro-economic and micro-economic realities in both China and the West; and Professor Ratnatunga was a leading expert in marketing, finance and international business at the corporate level.

Professor Ratnatunga, having trained as a Chartered Accountant when the government of Sri Lanka was pursuing a socialist agenda in the early 1970s, had witnessed first-hand what such policies could do. Sri Lanka had become a country that was plagued by high inflation and taxes, a dependence on food imports to feed the populace and high unemployment. The Bandaranaike government passed a Business Undertaking Acquisition Act, allowing the state to nationalise any business with more than 100 employees; ostensibly aimed to reduce foreign control of key tea and rubber production.

The net result was that it stunted both domestic and foreign investment in industry and development. However, throughout this period in Sri Lanka, despite a political veneer of Socialism, a vibrant market-economy ran; with many local and foreign companies indulging in manufacturing and exporting. The laws were still based on British company and commercial laws; the accounting and auditing systems were based on generally accepted accounting principles (GAAP); and the banking system followed international accepted practices. Multinationals in the non-plantation and petroleum sector, such as Unilever, British-American Tobacco and Nestlé, were allowed to function as before.

Shanghai in Early 1990

However, none of Professor Ratnatunga’s experience of a ‘socialist’ economy in Sri Lanka, prepared him for what he encountered in China in January 1990; where a market-based economy was virtually non-existent. There were no recognisable legal and accounting systems that are fundamental to international trade. The Chinese banking system still lacked some of the services and characteristics that were considered basic in most countries. Interbank relations were very limited, interbank borrowing and lending was virtually unknown and checking accounts were used by very few individuals. Anyway, most of the Chinese entrepreneurs and officials were unaware of how these banking services worked.

Although small stock exchanges had begun operations somewhat tentatively in Shenyang and Shanghai in 1986, the concept of profit and shareholder returns were still alien concepts to most entrepreneurs in early 1990. Most enterprises were still state owned and had names such as ‘Shanghai Boot Company No.1’, ‘Shanghai Boot Company No.2’, etc. Even though these companies mainly produced only for a local and regional markets, given China’s population, the volumes produced were much larger than any similar company in the West. Also, as these companies had such a large domestic market; exporting was not on their radar. The managers were given production targets and not profit targets.

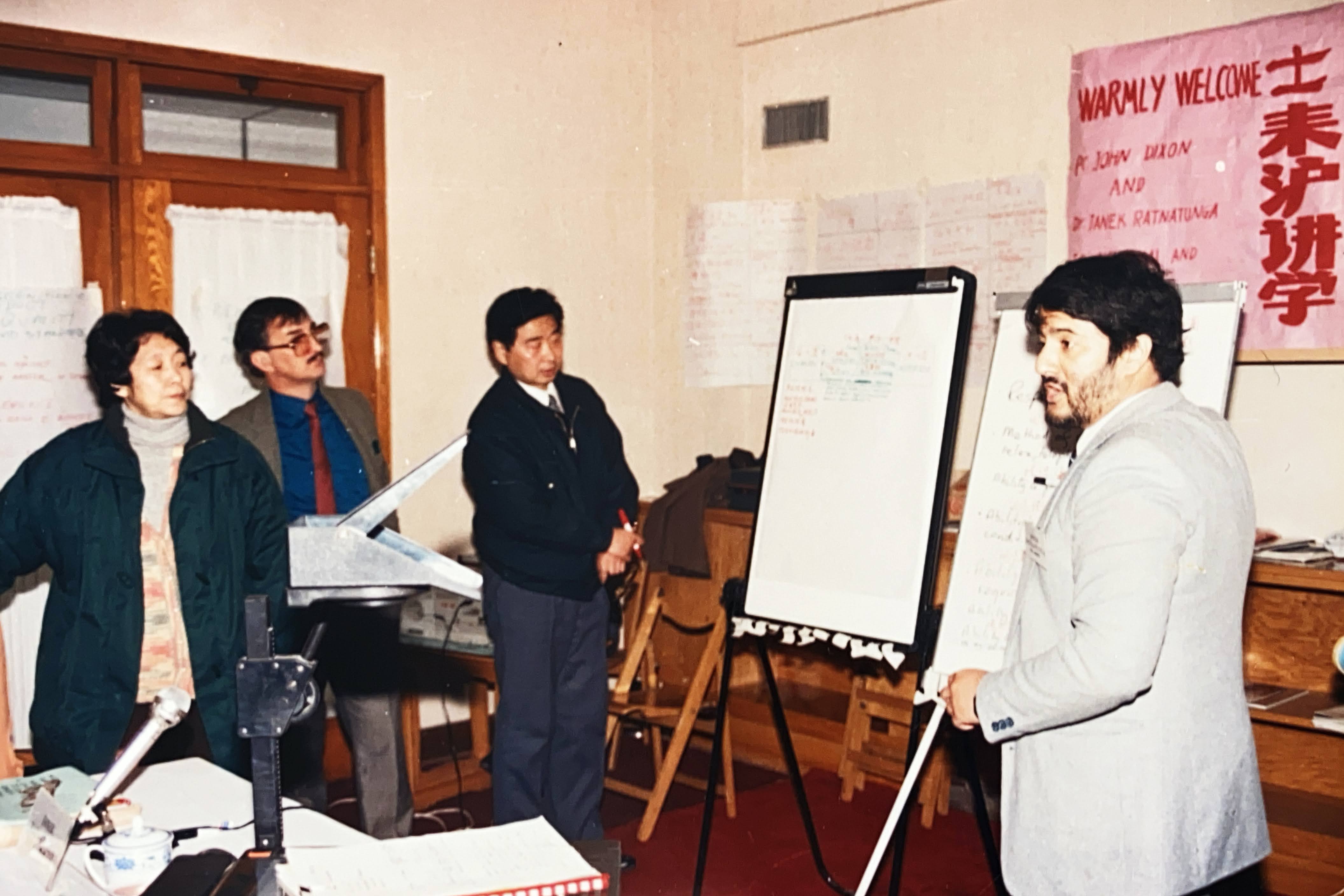

Professor Janek Ratnatunga lecturing and Professor Dixon looks on.

Given this environment, the first task of Professors Dixon and Ratnatunga was to conduct a series of seminars and workshops in Shanghai and Beijing to some selected entrepreneurs and those rising stars selected by the State Council — China’s highest-level decision-making body — which was charged with implementing the far-reaching market-economy reforms initiated by Chairman Deng.

The seminars and workshops were held over two-weeks in each of the cities, Shanghai and Beijing; and covered a wide range of market-economy issues such as stock markets, costing and pricing, exporting and export documentation, foreign exchange and hedging, branding and marketing, finance and international business.

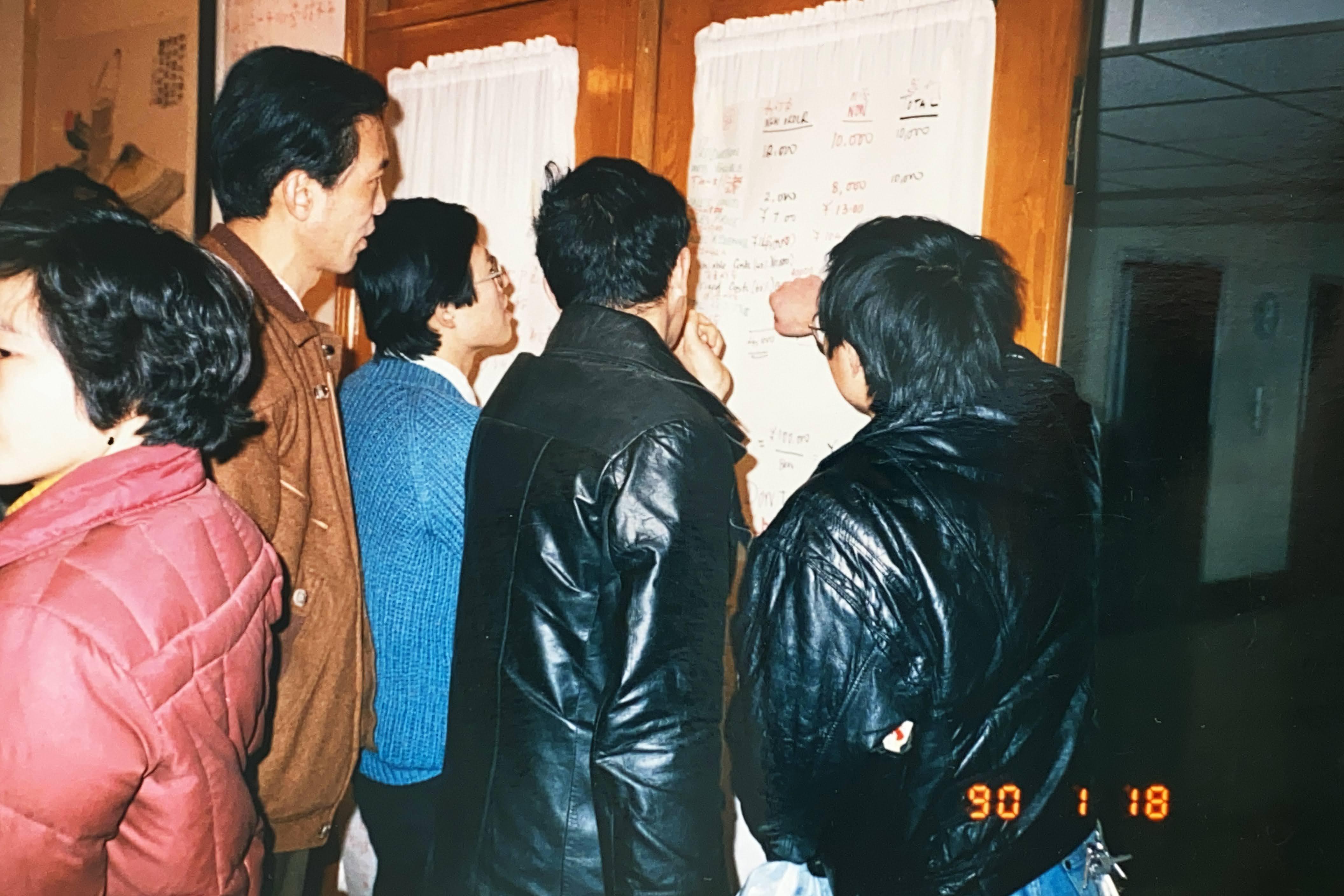

There was an academic who interpreted all lectures — sentence by sentence. Another interpreter wrote in Chinese under the English words written in the diagrams that were drawn on butcher’s paper. These diagrams were then pasted like posters all around the room; and every morning the participants had arrived at least two-hours before the professors to study and discuss what they had learnt the day before. This technique of ‘story-boarding’ is common in today’s international conferences, but were unique in early 1990s.The importance that the Chinese government placed on these seminars can be ascertained by the fact that often they were simultaneously translated and broadcast on Chinese State Television.

Students studying the work of the previous day from the posters.

In the evenings, after the seminars concluded, there were “Think-Tank” meeting with other senior officials of The State Council over a round-table dinner. Discussions covered the strategic directions that needed to be taken in China’s progress to a market-economy. There were interpreters taking notes throughout the daytime seminars and the “think-tank’ dinners. Some of the issues discussed included the need for a systemic restructuring of the banking system, including the need to recapitalize China’s banks and to reduce non-performing loans (NPLs) given to state enterprises; the continued lifting of price controls; and the reduction of protectionist policies and regulations. Professor Ratnatunga emphasised the need for China to have internationally recognised consumer brands; and slogans such as “Proudly Made in Shanghai”.

The seminars, workshops and think-tank sessions were so well received, that Professors Dixon and Ratnatunga were given the highest honour by The State Council in giving them lifetime appointments as Honorary Research Professors in the Shanghai Branch of the Economical, Technical and Social Development Research Centre of the International Technology and Economy Institute.

Professor Ratnatunga followed up the groundwork of the seminars with regular communication with the Institute throughout the 1990s, giving consultative advice on market-economy matters. He also made regular on-site visits to Beijing and Shanghai right up to December 2001.

Bicycles were the main means of transport in early 1990s

Today, 30-years later, many of the participants at the seminars, workshops and think-tanks hold (or have held) the highest positions in the Chinese government. When Professor Ratnatunga started delivering the seminars in early 1990, Beijing had 10-lane highways, with 9-lanes for bicycles and one-lane for cars. By the time his involvement in China’s transformation to a market economy was completed, the ratio of lanes for cars vs. bicycles had reversed. If Chairman Deng Xiaoping’s market reforms earned him the reputation as the "Architect of Modern China", then the oil that set the wheels in motion was undoubtedly the early work of Professor Ratnatunga and Dixon.

(Professor Kym Fraser is an Australian academic with an historical interest in the development of the business environment in China)

Leave Comments