According to the Central Bank, the external sector of the economy has recovered robustly since May 2009 and particularly, the external reserves have significantly improved.

This is clearly illustrated in the 60th Annual Report of the Monetary Board of th Central Bank of Sri Lanka which was submitted to the President of Sri Lanka and the Minister of Finance and Planning on 5th of April 2010 by the Governor of the Central Bank Ajith Nivard Cabraal.

According to the report, the economy has demonstrated its resilience by growing at 3.5% in 2009 amidst challenging domestic and external conditions, inflation declining to very low levels, and foreign reserves increasing to record high levels.

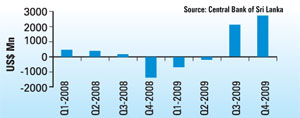

Balance of Payments - Quarterly Overall Balances

|

These achievements reported by the Central Bank were remarkable given the fact that the country was fighting the intensified final phase of its 30 year-long battle with one of the world’s most brutal terrorist groups.

The sudden withdrawal of short-term capital by foreign investors resulting from adverse global conditions was a severe strain on the country’s foreign reserves during the first few months of 2009.

As a result, the overall balance of payments touched $1,369 million which was just sufficient to cover 1.25 months of imports by February 2009.

Furthermore, the increased government expenditure on defence, salaries and wages, and on urgent resettlement, rehabilitation and reconstruction activities, as well as on continued public investments in infrastructure, widened the budget deficit.

This situation appears to have turned around with the end to the prolonged conflict and other policy actions of the Central Bank and the government, including the securing of the Stand-by Arrangement (SBA) from the International Monetary Fund (IMF) in July 2009, having applied for same in February 2009.

Balance of Payments - Quarterly Overall Balances.

Accordingly, the macroeconomic landscape has now changed dramatically with the end to the war against terrorism.

The Sri Lankan economy has recovered rapidly by 4th quarter of the year by recording a growth rate of 6.2%, and the Central Bank has projected that the economy would achieve a growth rate of 6.5% in 2010. It is also reported that the economy has managed to accumulate a sizable level of reserves which would be sufficient to cover more than 5 ½ months of imports compared to the targeted level of 3½ months by 2011 as per the agreement reached with the IMF.

The Central Bank projections also show that BOP would continue to record surpluses in the coming years and foreign reserves would increase continuously. Before the release of the annual report, the Central Bank had also announced that the economy has successfully met the IMF targets set for March 2010.

In the light of these facts, Central Bank should now carefully reconsider whether there is still a need to continue with the IMF - SBA facility any longer as there seems to be no BOP crisis at present. Besides, these funds cannot be used for development purposes, and drawing from this facility will merely increase the foreign indebtedness of the country.

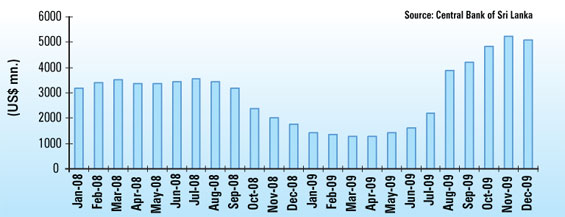

Official Reserves of the Country

IMF has been providing financial assistance to its member countries for short-term BOP needs through SBA facilities.

This has been the most extensively used facility of the IMF. There are some benefits that SBA offers over other facilities. SBA allows the member countries to correct their BOP imbalances that occur temporarily without having to resort to trade and payment restrictions.

This, therefore, is a “short-term” facility by definition, which is obtained on temporary basis to prevent any difficulty in trade and payment flows.

If Sri Lanka is no longer in a BOP crisis situation and has managed to maintain a reserve level in excess of $5 billion, surpassing the level initially specified in the agreement with the IMF and nearly doubling the average reserve level of around $2.5 billion maintained by the Central Bank over the past three years, the “short-term” need of an SBA facility does not seem to exist any more.

As such, there appears to be a strong case for re-evaluation as to whether Sri Lanka should obtain any further funds from the IMF. Furthermore, as a nation that has been using IMF facilities, Sri Lanka should assess the effectiveness of this facility in generating economic and financial benefits.

What is the purpose of getting indebted if the “short-term” crisis has already been averted, and the borrowed funds cannot be utilized for development purposes, particularly when the country is facing the need to spend a sizable share of her future investment on rehabilitation and reconstruction of the Northern and Eastern Provinces? Can a policy that leads the economy to keep a huge amount of money in the form of foreign reserves with inadequate “returns” on such reserves owing to very low global interest rates be justified, particularly when the economy faces shortage of capital for essential development purposes?

The only benefit that Sri Lanka could possibly derive through this facility at present seems to be the so called “international investor confidence”. It is high time that we appraise the benefits and costs of available alternative strategies to develop investor confidence.

Surely, the investor confidence is not gained solely based on the amounts borrowed from the IMF, but rather on the prudence of our economic policies and their effectiveness in facilitating investment and providing investors with a conducive investment environment.

It may well be the case that the government and the Central Bank have maintained the terms associated with the IMF facility which are said to be in line with the macroeconomic targets Sri Lanka has set for herself. If so, the Central Bank must now pursue achieving the set targets without availing itself of the facility of borrowing funds over and above the required amounts.

The IMF facility was meant to face a particular economic conjuncture.

It was a protective cloth for our economy during an international economic winter. Wise people do not wear winter cloths through hot summer as well, and suffer. It is high time that Sri Lanka correctly asses the economic climate, and reconsider continuation with SBA of the IMF.

(The writer is a senior lecturer in Economics at the University of Colombo)

Official Reserves of the Country

|

|